A Super prognosis for Jim McMahon

/Sunday marks the 50th anniversary of the biggest football game of them all: the Superbowl. In honoring heroes of gridiron's past, ESPN's award-winning 30-for-30 series recently provided a documentary on the winners of Superbowl 20: the 1985 Chicago Bears.

You know the names. Walter Payton. Refrigerator Perry. Former Razorback and NFL Hall of Famer Dan Hampton. Mike Singletary. Steve McMichael. Willie Gault. I remember Willie Gault being the guy you threw the ball to when you weren't giving it to Bo Jackson on Tecmo Bowl. There was also Gary Fencik. Wilbur Marshall. Dave Duerson. The list goes on and on.

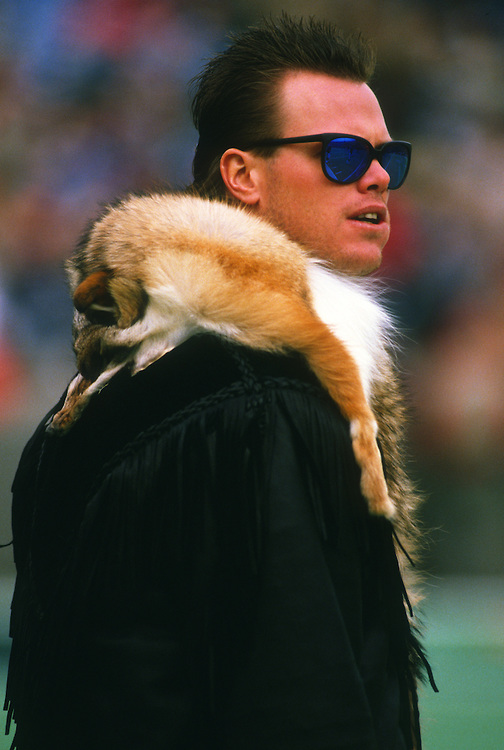

And then there was the QB. The guy who personified the whole team. The sunglasses. The look. The attitude. The "Punky QB." Jim McMahon. The cocky BYU QB gave the Bears offense the balance it needed to win, and win big. I probably haven't told you anything you did not already know (including Willie Gault being the Raiders go-to wide receiver on Tecmo Bowl).

What you may not know is how McMahon's life has been since retiring from football. Over the last few years, several NFL players have been diagnosed with "Chronic Traumatic Encephalitis." The only way to diagnosed the disease is posthumously. Several former players have been diagnosed, such as Frank Gifford and Ken Stabler.

Some players have committed suicide as a result of the symptoms, such as Junior Seau.

McMahon is different. He has experienced the same symptoms of the now deceased ex-NFL players. Through an acquaintance, McMahon received an upright MRI in upstate New York. The doctor "took a closer look at McMahon's neck and found that the top two vertebrae were misaligned, which caused a blockage of his cerebral spinal fluid."

McMahon ended up in a nearby office of a doctor specializing in treating disorders of the upper neck. Once properly adjusted, McMahon described the relief as "a toilet flushing."

The same cerebral spinal fluid blockage McMahon lived with for so long has been linked to whiplash associated disorders.

In a 2010 study published in the Brain Injury Journal, researchers took 1,200 people and subdivided them into four groups. One subdivision involved non-trauma versus trauma (from motor vehicle collisions). The other subdivision involved an upright versus lying down specialized type of MRI sequence that took place on each individual.

The researchers wanted to know how far the lower brain extended down into the base of the skull in each subgroup. An imaginary line was drawn across the base of the head from which to measure, as seen below:

The findings showed the lower brain in the trauma group to be significantly lower than the lower brain in the upright and lying down MRI groups. This effect was seen 2.5 times more often in the upright trauma group versus the lying trauma group; and seen 4 times more often in either of the non-trauma groups. The authors concluded

“Unless the difference between trauma and non-trauma cases was a result of unforeseen variability, it is reasonable to conclude these results reflect a degree of gravity dependent instability in the trauma group that was not observed in the non-trauma group. It is probable that the differences observed between the study groups were due to the independent variables of interest rather than some unforeseen bias between the groups.”

The upright MRI explains the differences between the upright and lying down groups, as well as McMahon finding out what was wrong with him. The authors of the study stated the lower brain extending down into the base of the skull "is due to the fact the flotation level of the brain is dependent on the amount of cerebral spinal fluid within the dural covering of the spine and brain." Crash trauma causing a dural leak could result in a cerebral spinal fluid leak and lowered pressure," resulting in the lower brain causing a cerebral spinal fluid blockage at the base of the skull.

McMahon had this to say about the problems facing former NFL players: "Let's raise the awareness about this problem. I wish they had figured out what was wrong with me sooner, but at least I got some help. Let's help others out there and let's deal with the problem."

The same could be said of injury victims in car wrecks. The 30-for-30 documentary on the '85 Bears premiered on February 4, 2016. It had a segment discussing McMahon's journey after football. Watch this segment as well as the rest of the documentary about "the Superbowl Shuffling" Bears.